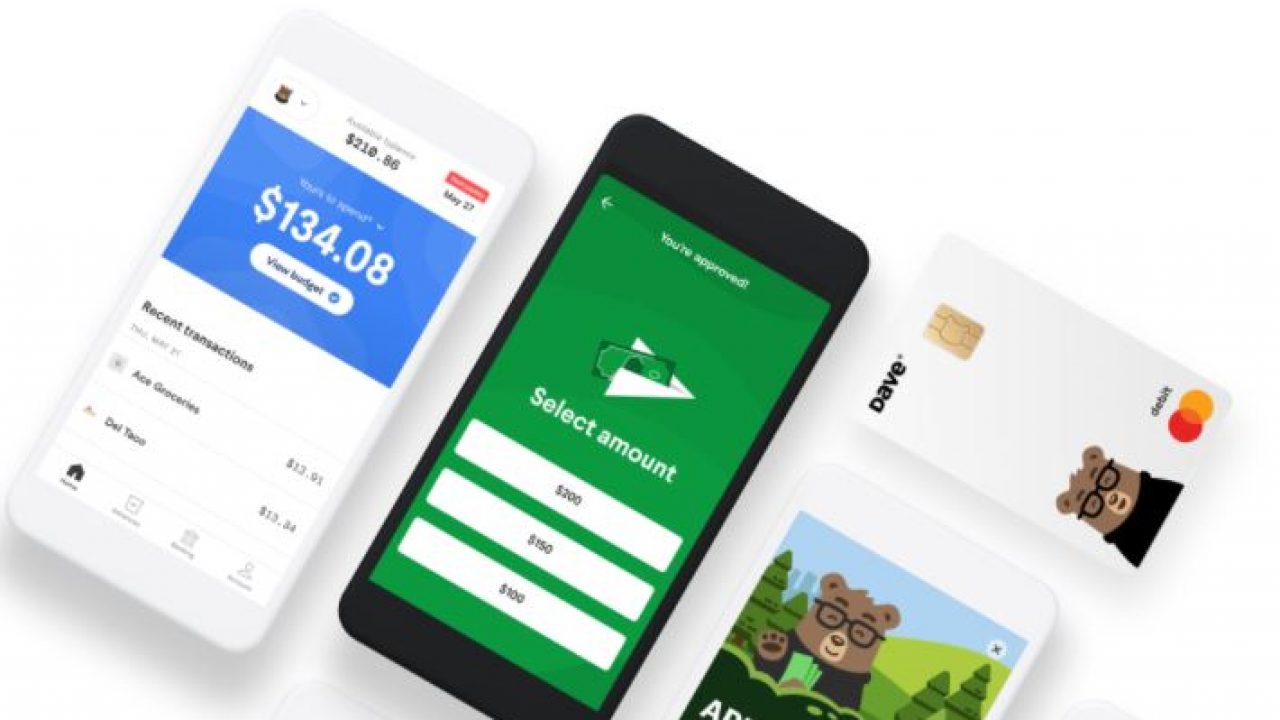

Cash app loans work similarly to using a payday loan service, but in a much more convenient form right through their app. Dave will automatically withdraw the amount you borrow from a linked bank account if you don’t pay it back manually before it’s due.

Low cost banking and cash advance interest rates.

Can you borrow money from dave with cash app. Get paid up to two days early*, build your credit history,** and get up to $200 advances without paying a fee. Borrow money app no credit check: You don’t pay interest with dave, but there is a $1/month fee to get access to dave loans.

The dave app is easy to download and install, just pop into google play or the app store. The best feature of dave app is called “side hustle” which helps users to find more ways to earn income. Meet the banking app on a mission to create financial opportunity that advances america’s collective potential.

I remembered i’d installed the dave app a couple of weeks ago and within a few minutes, i was approved for a small loan and because i paid the extra $4.99 expedite fee, the money was deposited into my bank account within the hour. Another feature is you can borrow a greater amount of money if you use a dave spending account. But it's limited to a select number of states, and you can only borrow up to 10% of your direct deposit per pay period.

We’ve rounded up four apps like dave that you may want to consider. Dave only charges a $1.00 fee to loan you the money plus any tip you’re willing to donate, but is not required. You can get up to $250 per pay period automatically deposited into your checking account — beating out dave by a few days.

Unfortunately, you may only borrow $100 at a time so it’s a “borrow 100 dollars” app. Created to help people avoid bank overdraft fees, the dave app alerts you when your checking account balance is getting low and lets you request cash advances to help cover upcoming expenses until your next paycheck. With dave, you can easily borrow small amounts of $25, $50 and $75.

Check out our deep dive on cash app’s safety measures for more details about the steps they take to ensure their users’ safety. If you have a regular job and enough income to repay their loan, you should qualify. If you decide to open dave banking account, you will be able to increase your ability to withdraw the funds so that you can borrow up to $200.

It acts like an overdraft protection but without the associated fees. Mobile apps like dave offer people the ability to borrow small amounts of money in the form of cash advances. Unlike pay advance apps that use your hourly work history to determine the amount, dave works a little differently.

The $1 membership fee makes this a more affordable option than the typical $35 overdraft fee charged by traditional banks. Each month $1 will be charged from your card allowing you to use this app and its services. If your account balance is short to cover an expense, you can get an advance of up to $100 on the dave app.

A credit card allows you to float expenses for up to 30 days, which could give you an opportunity to “borrow” money without paying any interest (provided you pay your card in full each month). Yes, cash app borrow is perfectly safe! If you set up your direct deposit with dave, you can get paid up to two days early (2), and build your credit (3) in the process.

10 million members and counting. But like dave, there are no fees or interest to borrow, and you won't have to worry about tipping. It’s easy to sign up and start balancing your budget.

Some have additional features such as overdraft protection and budgeting tools — but be aware that they may require a monthly membership fee. How does a cash app borrow loan work?